The principles of Sustainability were always an integral part of the Hellenic Culture. Ancient Greek concepts like Aristoteles’ idea of Eudaimonia – the art of the purposeful life – are back in focus, as possible recalibrations for a world in transformation, seeking solutions to current global environmental and social challenges.

Modern Greece experienced a decade of a serious financial and political crisis; this crisis has triggered the emersion of young entrepreneurs with fresh ideas, activists and innovators with the energy and creativity to develop new solutions for the country and the economy, and a new administration with the will to embrace change.

Public discussion in Greece in the last decades has been calling for investments to support economic development. We believe that sustainable and impact investments are the key to create a circular and regenerative economy in Greece.

Greece is a country with tremendous untapped potential currently missing the global “impact investing revolution”. It is an opportunity to revamp the economic model of Greece with impact values right now.

Natural resources, geography and climate conditions, cultural heritage, quality workforce and the “brain regain” potential, as well as the support from the Greek diaspora, create the fertile ground to promote impact investing.

The country has the potential to advance to one of the foremost impact investing hubs in Europe in several themes such as renewable energy, sustainable agriculture, sustainable aquaculture, blue ocean economy and sustainable tourism.

Post COVID financial recovery and strong GDP growth can support the fast creation of an impact investing market in Greece. When it comes to impact investing the country is still behind. There is no awareness around the methodology, no impact ventures ecosystem and lack of understanding from investors.

We are convinced that Greece, and Greeks globally, should be in the global vanguard of transformative use of capital to solve the world’s most pressing problems and put the country on the global impact map.

Impact investing is not an industry, nor an asset class, but rather a lens through which value creation is seen, across industries, geographies, asset classes etc.

From experience in other countries, we know that impact investing therefore needs an ecosystem that transcends these boundaries and established silos, in order to thrive.

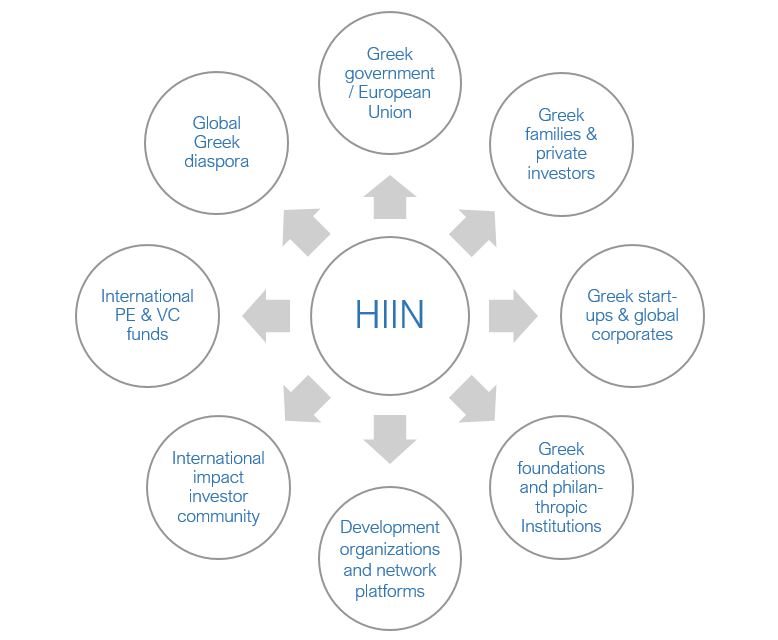

The nature of this ecosystem is horizontal rather than vertical, allowing for a complex interconnected network to exist. The HIIN operates as a silo buster improving collaboration and leveraging on the strengths and potential of each party.

In this Impact Ecosystem the HIIN’s strategy is two-fold:

a) impact focus: identify, attract and connect the impact investment-oriented actors across the relevant sectors, communities and silos in Greece (investment industry, banking, corporates, government, international organizations, angel investors etc.)

b) Hellenic focus: identify, attract and connect Greeks (and those interested in Greece) to the international community.

Our initial research shows that both these groups are extremely well placed, significant in size and resources, and – crucially – completely unconnected. We are therefore certain that the HIIN can create significant network value in a very short time by bringing all these actors together around a common purpose. Leveraging on the local and international impact and investment network of the HIIN team and advisors.

Subscribe now