Beyond this, we recognise additional dimensions essential to robust impact: additionality, where capital produces outcomes unlikely to occur otherwise; scalability, ensuring that solutions, and therefore impact, can grow; UN SDG alignment for coherence with international priorities; capital mobilisation, which attracts further investment; risk-adjusted returns, where possible, compatible with strategy; systemic contribution to root-cause change; and transparency via clear measurement and reporting. Every impact investment must fulfil the basic characteristic, but not every impact investment must have all further characteristics. However, the most high-integrity and powerful impact investment will.

The HIIN was the first to define Impact Investing in Greece publicly as

“ΕΠΚΑ Επενδύσεις Κοινωνικού και Περιβαλλοντικού Αντικτύπου”

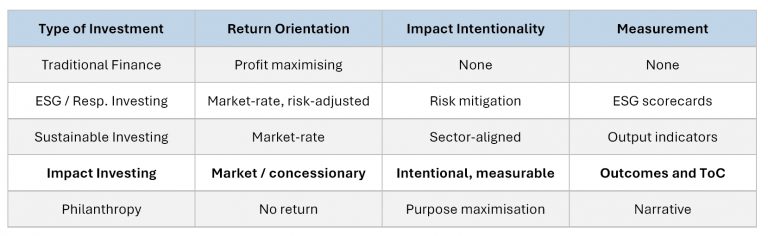

To clarify impact investing’s unique position compared to other strategies, consider the following:

This visual cuts through the ambiguity that often surrounds sustainable finance by drawing sharp distinctions between impact investing and adjacent approaches like ESG integration or thematic strategies. The act of doing this acts as a safeguard against impact washing, an increasingly pervasive risk, by reinforcing the disciplined and consistent use of language and concepts. The HIIN views as essential to protecting the credibility of the impact investing field in Greece.

We recognise that the impact investing landscape comprises diverse methodologies. Some investors prioritise social returns over market returns (“impact first”), others balance financial returns with impact and still others invest primarily for financial gain with secondary impact objectives (“return first”). The HIIN embraces each approach, provided investments maintain integrity in the form of clear intent, measurable outcomes, and transparency.

Impact is not exclusively generated by newly created ventures with an impact-first mission. A growing area of debate in the global impact community concerns whether investments into traditional businesses, with the intention of helping them transform toward impact alignment, should fall under the umbrella of impact investing. While some impact-purists argue that only ventures founded with a social or environmental mission should qualify, others highlight the transformative potential of enabling mainstream enterprises to integrate impact goals at scale. At the HIIN, we recognise and support this transitional approach as part of our working definition of impact investing, provided it is pursued with intentionality, a credible plan for impact, and clear measurement and accountability mechanisms. Whether it involves shifting to circular production models, adopting inclusive governance, or implementing clean energy transitions, such investments can lead to significant systemic improvements when properly structured. If the world is to transition to a more sustainable economy, we must bring these companies with us.

This is particularly important in Greece. With increasing volumes of private and public capital now flowing into the country, especially through recovery funds, green transition instruments, and infrastructure programmes, the urgency to build an investable impact pipeline is clear. Given the relative immaturity of the Greek impact ecosystem, transitioning existing enterprises into impact-aligned models represents a realistic and necessary path to scaling outcomes.

True impact journeys must also look beyond outputs to systems change. Transformative outcomes arise from investment strategies that reshape policy, infrastructure, markets, and behaviours. In Greece, a country containing interconnected public and private systems, a systems perspective offers pathways to deeper and more resilient impact. And once the above criteria are met, an impact investment should also be thematically aligned. The United Nations Sustainable Development Goals (SDGs) offer more than a set of global aspirations. They serve as a diagnostic roadmap for impact investors, signalling where capital should flow to achieve urgent societal and environmental priorities. When an investment is explicitly aligned with SDG targets, it gains both strategic direction and accountability, helping investors focus on what matters most.

Clearly, the field is evolving. Debates around public-equity impact, systemic versus project-level outcomes, and the role of concessional returns are not signs of instability, they are indicators of maturation. Greece’s integration into this dynamic discourse is critical for maintaining credibility and relevance.

As Greece begins to formalise and expand its impact investing landscape, it is natural, and welcome, that questions and debates around definitions will emerge. In fact, such debate is essential to building a resilient and credible ecosystem. Definitions do not exist in a vacuum; they evolve through use, contestation, and refinement. The HIIN openly welcomes feedback, different viewpoints, and public dialogue on how impact should be defined, applied, and evaluated. We believe that a lively debate will only strengthen the Greek market. This mirrors the journey taken by many other countries in the early stages of ecosystem building. Debates about how to define and measure impact continue in more mature markets, including the UK, Germany and Switzerland. Greece is no exception, and we view this moment as an opportunity to spark widespread engagement and collective learning.

“Impact investing begins with definition.

But it thrives through discipline, dialogue, and a shared purpose.”

Over the past six years, the HIIN has played an important role in equipping Greek stakeholders with internationally aligned frameworks while translating them for local relevance. As the ecosystem grows, our role evolves, from advocating for definitions to ensuring their disciplined application. We stand beside every investor, entrepreneur, policymaker, and ecosystem partner to offer guidance and education. What remains non-negotiable, however, are the foundational pillars that underpin all credible impact investing: intentionality, measurability, financial return appropriate to the strategy, and accountability to outcomes.

Is a methodology that can apply to any industry, asset class, geography

Does not compete / relate to philanthropy and development aid (but works synergistically with them)

Is the key to address the UN global challenges ahead & close the financing gap in time

Is here to stay, is growing fast and has a tremendous upside potential

Experiences high demand especially from families and HNWI

Is developing to a core wealth management optimization tool

Can prove to be a unique business opportunity for wealth/asset managers and banks

Can diversify portfolios with innovative, uncorrelated investments

Can successfully address family succession issues and inspire the next generation

Faces challenges, needs careful approach, and the help of the right experts

We align our definition of impact investing with the definition provided by the Global Impact Investing Network (GIIN)

Subscribe now